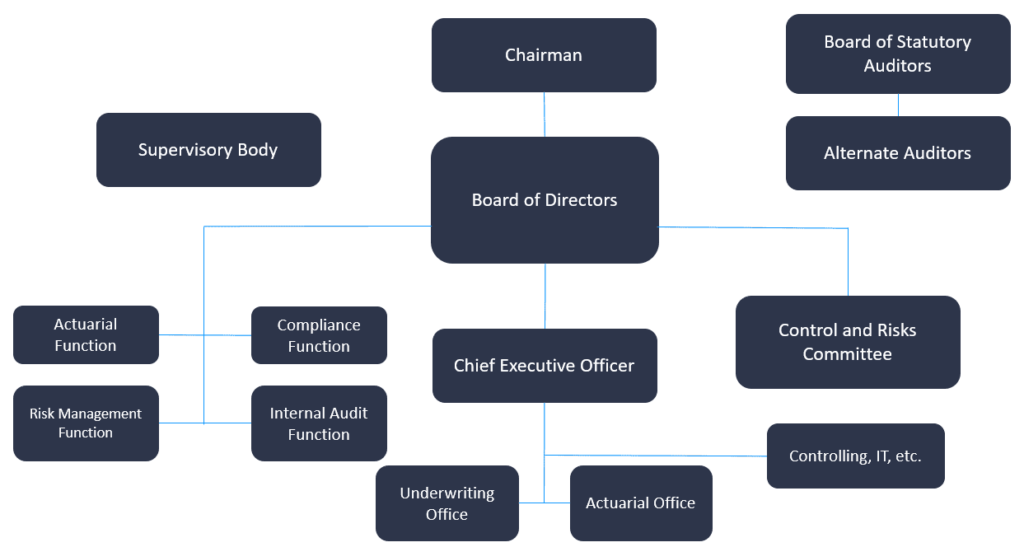

Governance

Organization chart

Board of Directors

Dott. Giovanni Zancan

Chairman

He has held the position of Group Finance Senior Vice President of Prysmian S.p.A. since 2005. Previously he was Project Financing Director of Pirelli & C S.p.A., Finance Director Pirelli Real Estate S.p.A. and Finance Director Latin America of the Pirelli Group.

Dott. Alessandro De Felice

C.E.O.

He has held the position of Chief Risk Officer at Prysmian S.p.A since 2005, and previously served as Risk Manager EMEA at Pirelli S.p.A. He was president of the National Association of Risk Managers and Corporate Insurance Managers ANRA from 2014 to 2020.

Prof.ssa Diana Valentina Cerini

Independent director

She is a lawyer specialising in regulation for insurance companies and intermediaries, insurance and reinsurance contracts and corporate transactions for companies in the financial segment. She is a full professor of comparative private law at the University of Milan Bicocca and professor (professeur vacataire) of European Insurance Law at the Université de Luxembourg, LLM advanced training. She has previously held courses in Insurance Law (University of Milan Bicocca), Private Law and European Contract Law (LIUC University) and has taught and/or lectured in numerous university masters courses in the field of insurance, including those at L. Bocconi University, LIUC, University of Milan, University of Parma.

Dott.ssa Maria Antonia Carminati

Non-executive director

She has held the position of Group Treasury Director in Prysmian since 2015. Before this experience she was Head of the Trade and Corporate Finance and Deputy Treasurer, always at Prysmian. Previously she held various roles in the Pirelli finance department.

Dott. Stefano Invernici

Non-executive director

He currently serves as the Senior Vice President of Group Administration at Prysmian S.p.A., overseeing the preparation of the consolidated financial statements, managing the European administrative service center, ensuring administrative governance, and leading Group administrative projects. Since 2021, he has also held the position of Group ‘dirigente preposto’ (manager in charge of financial reporting). Prior to this role, he worked as the Financial Manager at Hexion-Momentive BV in Rotterdam (NL), as a Senior Financial Analyst at Medtronic BV in Amsterdam, and as a Senior Auditor at EY Italy.

Board of Statutory Auditors

Dott. Pietro Carena

Chairman

Dott.ssa Annalisa Firmani

Standing statutory auditor

Dott. Fabio Facchini

Standing statutory auditor

Dott. Stefano Rossetti

Alternate auditor

Dott.ssa Laura Gualtieri

Alternate auditor

Control and Risk Committee

Dott.ssa Diana Cerini

Dott.ssa Maria Antonia Carminati

Dott. Stefano Invernici

Fundamental functions

Risk management function – Ing. Lisa Cattaneo

Head of Risk management Function: Ing. Lisa Cattaneo

The Risk Management Function performs the tasks set out in IVASS Regulation No. 38/2018, including:

- contributing to the definition of the risk management policy and operational limits;

- validating information flows to control risks exposure;

- contributing to the risk and solvency assessment activities;

- redacting reports for the Board of directors and the internal stakeholders on the evolution of risks;

- verifying the consistency of the risk assessment models with the daily company’s operations;

- verifying the consistency of the internal model with the company’s risk profile;

- monitoring the implementation of the risk management policy.

Actuarial Function – Dott. Vincenzo Suriano

Head of Actuarial Function: Mr. Vincenzo Suriano

The Actuarial Function performs the tasks set out in IVASS Regulation No. 38/2018, including:

- coordinating the calculation of technical provisions;

- controlling the adequacy of the methodologies, underlying models and assumptions on which the calculation of technical provisions is based;

- assessing the quality of the data used to calculate technical provisions;

- assessing the overall underwriting policy.

In order to contribute to the effective implementation of the risk management system, the Actuarial Function provides support to the Risk Management Function with respect to:

- identify and map the risks to which the Company is or may be exposed;

- define methodologies for calculating the capital requirement of technical risks, both in a current and prospective perspective, within the ORSA process;

- risk analysis and assessment through quantitative and/or qualitative methodologies;

- assessments within the framework of stress testing activities;

- preparation of reports to the administrative body.

Internal Audit Function – Dott.ssa Paola Pulidori

Head of Internal Audit function: Dott.ssa Paola Pulidori

The Internal Audit Function performs the tasks set out in IVASS Regulation No. 38/2018, including verifying:

- the accuracy of management processes and the effectiveness and efficiency of organisational procedures;

- the regularity and functionality of information flows among the Company;

- the adequacy of information systems and their reliability so that the quality of the information on which top management bases its decisions is not affected;

- the compliance of administrative and accounting processes with the criteria of accuracy and regular bookkeeping;

- the effectiveness of the controls carried out on outsourced activities.

Furthermore, the head of the Internal Audit Function is responsible for achieving the objectives of the Internal Audit Policy and communicates to the administrative body the assessment of the results and any malfunctions and critical issues.

Compliance Function – Dott. Giorgio Totis

Head of Compliance Function: Dott. Giorgio Totis

The Compliance Function performs the tasks set out in IVASS Regulation No. 38/2018, including:

- identifying on an ongoing basis the rules applicable to the company, assessing their impact on the company’s processes and procedures, providing support and advice to the corporate bodies and other corporate functions on matters for which the risk of non- compliance is relevant;

- assessing the adequacy and effectiveness of the organisational measures adopted to prevent the risk of non-compliance with regulations and proposing organisational and procedural changes aimed at ensuring adequate risk control;

- assessing the effectiveness of the organisational upgrades resulting from the suggested changes;

- preparing adequate information flows to the corporate bodies of the company and to the other structures involved.

The Function also promptly informs the corporate bodies and the other Functions concerned of cases of significant exposure to the risk of non-compliance or of significant breaches of the compliance system (whether or not requiring timely notification to the Supervisory Authority by law) detected during checks carried out on a programmatic or ad hoc basis.

Operational functions

Actuarial Office – Dott.ssa Marta Soldavini

Head of office: Dott.ssa Marta Soldavini

The Actuarial Office performs the tasks set out in the internal Risk Management and Reserving Policies, including:

- calculation of technical provisions according to Local and Solvency II principles;

- calculation of the SCR and MCR according to European Solvency II Directive;

- development of assumptions for actuarial calculations;

- implementation of international accounting standard IFRS 17;

- data and trend analysis of the entire contract portfolio;

- quantitative support in pricing to the Underwriting Office;

- support in the preparation of reporting to the administrative body and supervisory authorities.

Underwriting Office – Gabriella Fraire

Head of office: Gabriella Fraire

The Underwriting Office performs the tasks set out in the internal Underwriting Policy, including:

- Profitably underwriting the Prysmian Group’s selected reinsurance risks;

- Ensuring alignment between business strategy and business mix, risk allocation, maximum exposures and aggregations;

- Ensuring that adequate and effective risk management systems and controls are in place to support the risk selection and underwriting process;

- Reporting to the Board of Directors on underwritten programmes, including the performance of those programmes;

- Ensuring that all business underwritten by the Company is in line with licences and authorisations granted by IVASS;

- Ensuring that the Company has sufficient capital from both a regulatory and policyholder perspective to underwrite the selected risks.